Oct 14, 2008

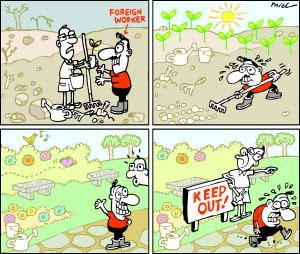

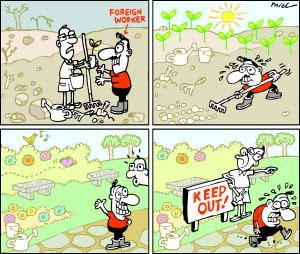

Workers are human, too Integrate, not segregate: That should be the way as their numbers grow

By Lydia Lim, Straits Times.

WORKERS were summoned and human beings came. That was how Swiss author Max Frisch summed up the situation in post-war Germany.

In the midst of a reconstruction boom, 1950s Germany recruited tens of thousands of manual labourers from the poor countries of Europe and the Mediterranean coast.

The Germans called them gastarbeiter, or guest workers, for guests were expected to leave after a while.

Today, booming city states like Singapore are doing the same.

There are now 577,000 foreign workers here, excluding maids. They, too, are guest workers, here for the short term to oil the engine of economic growth.

A third of them, or about 180,000, do construction work. Others staff factory lines. Yet others are cleaners.

As a nation, we are painfully aware of our economic dependence on these workers. But we also seem to have reduced them to mere factors of production.

We seem to have lost sight of the reality that these are human beings and like us, they have human needs.

The recent furore over the conversion of an old and vacant school building in Serangoon Gardens into a dormitory for foreign workers makes that patently clear.

The Government announced last week that it would go ahead with the dormitory but to appease residents, it would seal off the entrance that opens out into Serangoon Gardens to both vehicles and pedestrians.

The 600 workers to be housed in the dormitory will only be able to enter and exit via a new, built-to-order 400m slip road that will lead into the Central Expressway and Ang Mo Kio Avenue 1.

So even though these workers will live temporarily within one of Singapore's more mature and pleasant housing estates, they will have no direct access to its shops, parks or eating places.

They will be fenced in and kept apart from the estate's other residents.

A request was also made to Member of Parliament Lim Hwee Hua for shuttle buses to ferry the foreigners - not to Serangoon Gardens of course - but to areas like Bishan and Ang Mo Kio Central on weekends.

We as a society need to ask ourselves if that is an acceptable way to treat fellow human beings.

Why do we feel we have a right to deny foreign workers the good things we ourselves enjoy, including a chance to walk about freely and mingle with others?

Imagine if you or your son or daughter were to go to another country to work and be at the receiving end of such treatment. How would you feel?

National Development Minister Mah Bow Tan stressed last month that segregation cannot be the way forward, not at the rate the foreign worker population is growing.

Their numbers swelled by 102,000 last year alone, double the jump of 55,000 a year ago. And with major construction works lined up, a let-up is unlikely.

Singaporeans, Mr Mah said, must 'be prepared to see them and share with them our common spaces'.

But actions speak louder than words. And in the case of Serangoon Gardens, the Government's response to residents' complaints has been to provide precisely what Mr Mah spoke out against - segregation.

One issue that merits closer examination is the extent to which Singaporeans take the cue from the Government, which has one policy for foreign workers and another, contrasting one for foreign talent.

While there is an economic rationale for such a two-tier approach to regulating the entry and exit of different types of foreigners, such policies also shape people's attitudes.

There is little doubt that as a result, some locals feel distinctly inferior to foreign talent, while others seem to believe they have licence to treat those here on work permits as a lower class of beings.

Any right thinking individual knows that there is no basis for such feelings of superiority.

Most Singaporeans only have to look a generation or two back to realise that the only thing that separates them from foreign workers is the good fortune of having been born in a wealthy and developed city state.

To be sure, Singapore is not unique in its handling of migrant workers.

Compared to some countries in the Middle East, the treatment that foreign workers receive here may seem civilised.

In Dubai, for example, where more than 80 per cent of the work force is foreign, labourers from India, Pakistan and Afghanistan who toil to build skyscrapers and luxury hotels live out of sight in temporary labour camps in the desert.

But is that the direction we want our society to head in? I think we can and should do better.

Some residents of Jalan Kayu and their MP Wee Siew Kim have demonstrated a more humane way forward.

After 6,000 foreign workers moved into the neighbourhood, grassroots leaders and police officers roped in 38 workers to help them patrol the area.

They organised a walk-a-jog around the foreign worker dormitory, so residents and workers could get to know each other better.

Our society needs more such community events, so Singaporeans can see for themselves that most foreign workers are just ordinary, hard-working folk like them.

The Government also needs to step up to the plate. It should review regulations that lend credence to the belief that foreign workers matter less.

The Land Transport Authority's refusal to ban the transport of foreign workers in lorries' cargo decks, for example, signals that these workers' lives are, to quote MP Halimah Yaacob, 'worth less than equipment'.

Let us remember that treating others with dignity is a mark of a civilised society.

(Source: Straits Times, Page A2, October 14 2008.)

After reading this article by Lydia Lim, i cannot help but agree fully with her that we should treat all foreign workers humanely and not carry a skeptical, prejudice and bias attitude towards them. As if everyone of them are criminals or would be criminals.

On the Government's decision to build a worker's dormitory at Serangoon Gardens, residents were unhappy, and many suggested that the govt build it at Tuas, Changi, Jurong etc. Citing reduction in property value if they were to be build there, crimes will rise, peace to be disturbed etc...

If i were to live there and having spend millions to buy a private house and wanting peace and serenitiy around my neighbourhood only to learn that in a years time, some 600 - 1000 foreign workers will come and live in my neighbourhood and traffic will be high due to the ferrying, i will be some what pissed. But to give suggestion to have it build at some other parts of Singapore, i will never suggest it.

What gives you the right to think that residence in some other parts of Singapore would be happy and joyful to having a Worker's dormitory just beside their house. Just so because you can afford the $2 million house gives u the right to feel that way and not others who are living in a $200k home?

They even have the cheek and no shame to even suggest that they be ferried to places like Bishan and Ang Mo Kio on weekend. Have they no shame? i cant believe they even suggest that, it only shows how low can they be when they have only their own interest to care about. Then what would the residence of Bishan and Ang mo kio think? What about the workers? dun they have a freedom or choice to make?

Because of them, they cant even visit the shops to buy neccesities as they are being blocked off. And because of their suggestions, taxpayers have to cough up another extra $2million to build a new route to the dormitory as the main gate have to be sealed off.

I came across a worker's dormitory at Yishun which entrance is facing the HDB ard and on week ends, i see workers enjoying themselves by sitting at the open field or gardens around their dormitory eating and chatting away and at night, going for their favourite Bollywood movies at Yishun Cinema. And all this happened without any fuss.

Kudos to the Singapore Government for not relenting to the request of those bias, selfish and Racist residence to build a dorm in other parts of Singapore.

We were at our grandma house on the 14th of Sep, which is my Grandma's english birthday. My sister bought a cake for my birthday! so touched!!!

We were at our grandma house on the 14th of Sep, which is my Grandma's english birthday. My sister bought a cake for my birthday! so touched!!! Was at Sim Lim square last week where i decided to check out the flea market just opposite Sim Lim Tower. you can really literally find anything there, from old clothings to broken records, Laser Disc, CD, VCD, fake Rolex (They really look very very real until you turn to look at the back of it).

Was at Sim Lim square last week where i decided to check out the flea market just opposite Sim Lim Tower. you can really literally find anything there, from old clothings to broken records, Laser Disc, CD, VCD, fake Rolex (They really look very very real until you turn to look at the back of it).